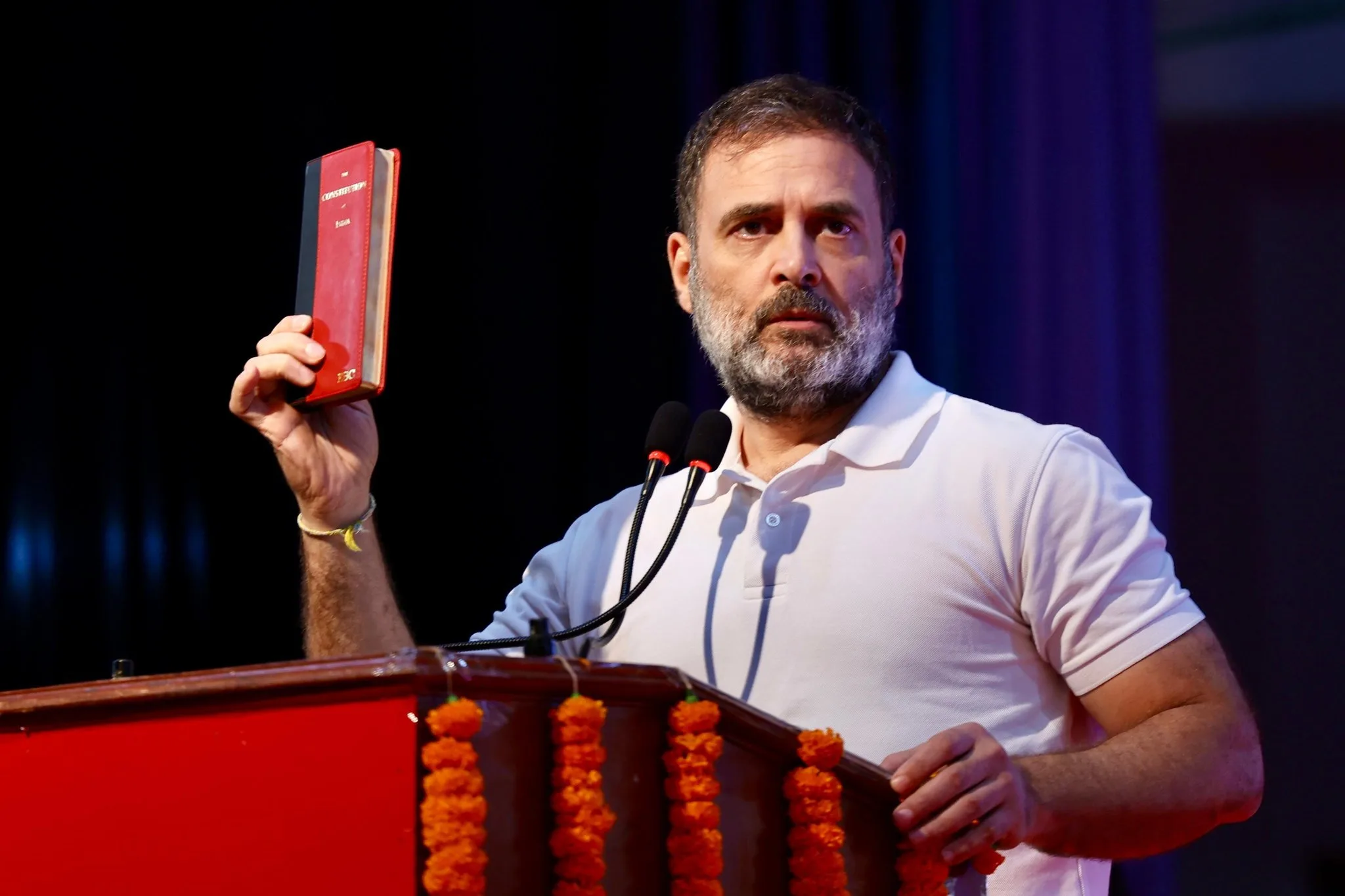

EC Tells Rahul Gandhi to Sign Declaration or Apologise over ‘Vote Theft’ Remark

Staff Reporter The Election Commission (EC) on Saturday renewed its demand for Congress leader Rahul Gandhi to either back his “vote theft” allegations with a formal signed declaration or issue…