Last Updated on August 13, 2020 2:48 pm by INDIAN AWAAZ

AMN

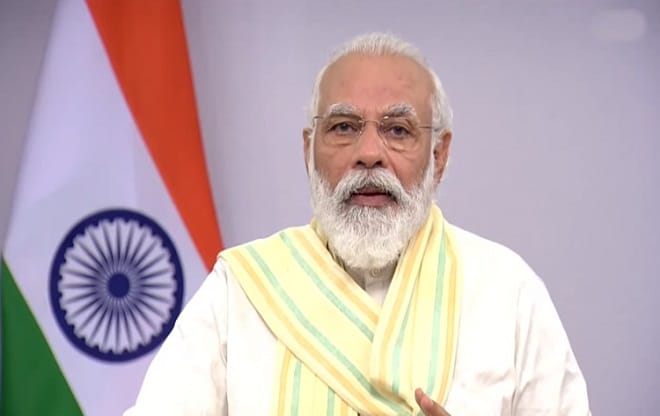

Prime Minister Narendra Modi has said that the tax system in the country is becoming faceless and it will give the tax-payer a feeling of fairness and fearlessness. Launching Transparent Taxation – Honoring the Honest platform through video conferencing in New Delhi today, Mr Modi said, tax administration should solve problems instead of confusing the tax-payer and everything from technology to rules should be simple.

He said, identities of the tax-payer and tax-officer should not matter at all. The Prime Minister said, the effort is to make the tax system seamless, painless and faceless.

He said, honest taxpayers play an important role in nation development. Mr Modi said while it is the responsibility of tax officers to deal with taxpayers with dignity, people should also consider paying taxes as their responsibility.

He said, Tax Payers Charter is a big step in the development journey of the nation. He added that it is a step towards bringing together rights and duties of the tax-payer and fixing the government’s responsibilities towards the taxpayer. The Prime Minister said, in the last 6 years, the Government focused on Banking the Unbanked, Securing the Unsecured and Funding the Unfunded. He said, during this time, India has seen a new model of governance developing in tax administration.

Mr Modi said, today, every law and policy is taken out of the process and power centric approach and emphasis is given to make it people centric and public friendly. He said, it is the new governance model of the new India and the country is getting good results from it.

Mr Modi said, looking at the commitment towards reforms, the confidence of foreign investors is also increasing continuously towards India. He said, arrival of record Foreign Direct Investment to India even during the Corona crisis is an example of it.

The Prime Minister said, new arrangements, new facilities starting today strengthens Government’s commitment to Minimum Government-Maximum Governance. He said it will strengthen efforts of reforming and simplifying India’s tax system.