Last Updated on July 23, 2024 7:14 pm by INDIAN AWAAZ

Staff Reporter / New DElhi

The Union Budget 2024-25 has listed out nine priorities for generating opportunities for all. These priorities are productivity and resilience in agriculture, employment and skilling, inclusive Human Resource Development and Social Justice, manufacturing and services, Urban Development, Energy Security, Infrastructure, Innovation, Research and Development and Next Generation Reforms.

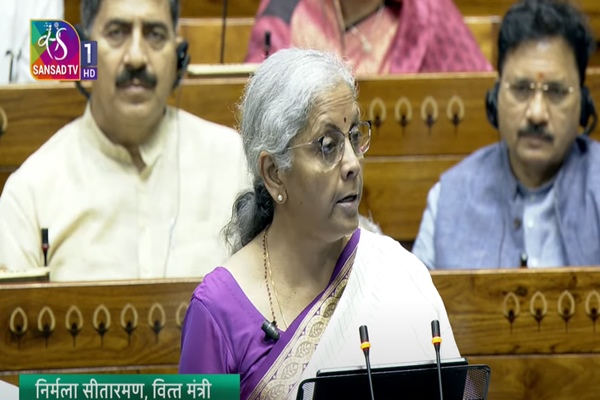

Presenting the Union Budget in the Lok Sabha today, Union Finance Minister Nirmala Sitharaman announced slew of measures to give boost to agriculture, MSMEs, Manufacturing and Infrastructure sectors. While addressing, the Finance Minister said, poor, women, youth and the farmer are the key focus areas for the government. She announced the Prime Minister’s Package for employment and skilling.

Under this, three schemes announced for employment-linked incentives. Under Scheme A, one month’s wage to all persons newly entering the workforce in all formal sectors will be provided. Scheme B will lead to job creation in manufacturing and Scheme C will provide support to employers. She said that significant investments have been made to build robust infrastructure and over 11 lakh crore rupees for capital expenditure have been allocated to boost the infrastructure in the country. Over three lakh crore for schemes benefitting women and girls was also announced by the Finance Minister.

The Finance Minister said, recognizing the capital requirement of Andhra Pradesh, the government will facilitate special financial support through multilateral development agencies in the current financial year and 15 thousand crore rupees will be arranged for the State. She said, new airports, medical colleges and sports infrastructure will be developed in Bihar. She said, additional allocation to support capital investment will be provided and the request of Bihar government for external assistance from Multilateral Development Banks will be expedited.

The Minister also announced that Mudra Loans will be enhanced to 20 lakh from the current 10 lakh for those entrepreneurs who have availed and successfully paid loan under the Tarun category. She said, E-commerce exports hub will be set in PPP mode. The Minister announced that the government will launch a comprehensive scheme for providing internship opportunities in 500 top companies to one crore youth in five years. Rental Housing with dormitory-type accommodation for industrial workers will be facilitated in PPP mode.

The Minister said, the government will set up a critical mineral mission for domestic production and recycling of critical minerals. She said, Transit Oriented Development Plans for 14 large cities having population over 30 lakhs will be formulated. She announced the PM Awas Yojana (Urban) 2.O, housing needs of one crore poor and middle-class families will be addressed with 10 lakh crore rupees. She said, the fourth phase of Pradhan Mantri Grameen Sadak Yojana will be launched. She also said, the NPS (Vatsalya) scheme for economic security of minors will be launched.

The Finance Minister also announced to exempt three more medicines of custom duties to provide relief to cancer patients. She also announced to reduce custom duties on gold, silver to 6 percent and that of platinum to 6.4 percent. She also proposed to increase the limit of exemption of capital gains on certain financial assets to 1.25 lakh rupees per year. To bolster the Indian startup system, she proposed to abolish the Angel Tax for all classes of investors.

On the Personal Income Tax front, two announcements were made by the Finance Minister. In the New Tax Regime, the standard deduction of salaried employees to be increased from 50 thousand rupees to 75 thousand rupees. New Tax Regime slab for taxpayers will be 0-3 lakh – Nil, 3-7 Lakh – 5 percent, 7-10- 10 percent, 10-12- 15 percent, 12-15- 20 percent and above 15- 30 percent.