Last Updated on July 11, 2023 10:08 pm by INDIAN AWAAZ

A R DAS

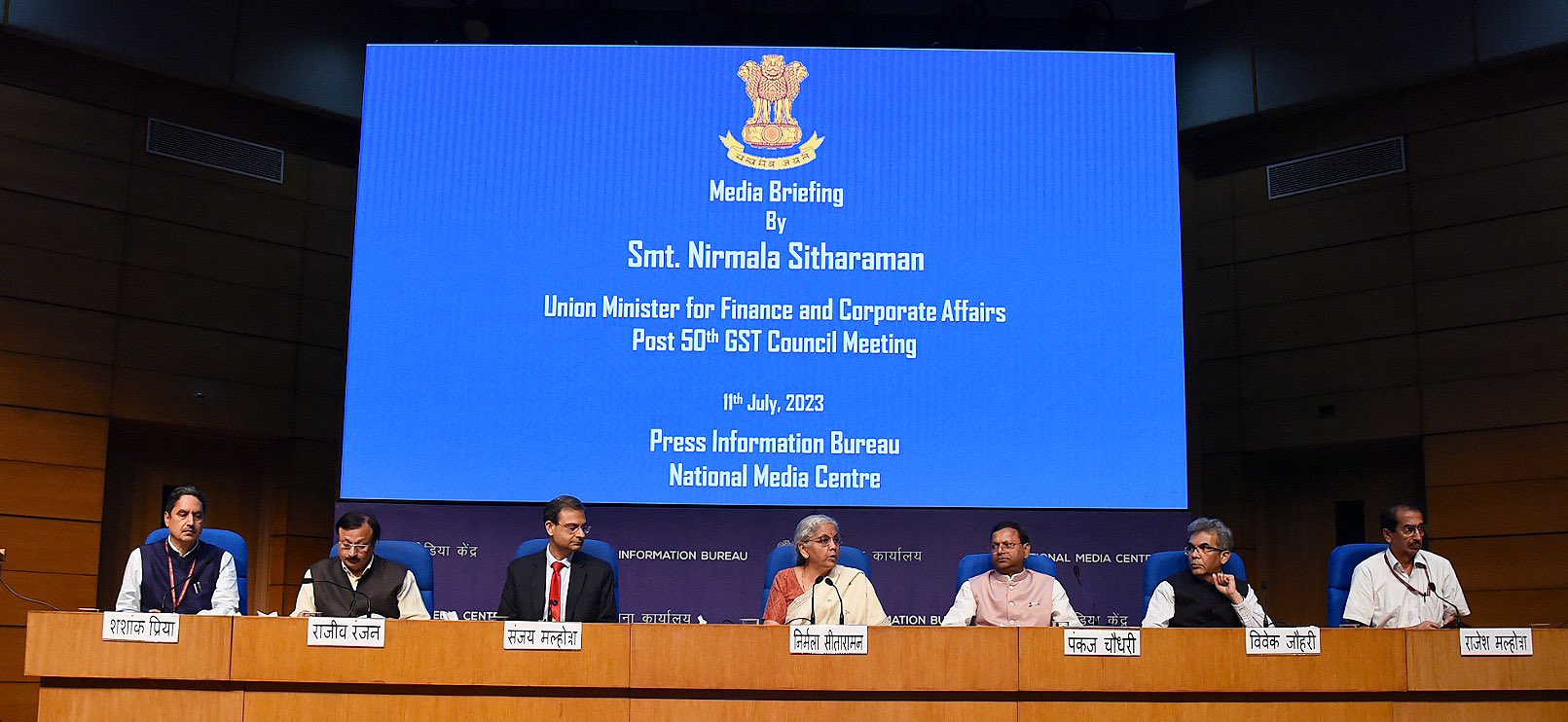

GST Council has decided to exempt cancer-fighting drugs, medicines for rare diseases, and food products for special medical purposes from GST tax. Union Finance Minister Nirmala Sitharaman today chaired the 50th GST Council meeting in New Delhi.

Addressing the media after the meeting, the Minister said 28 percent tax will be levied on online gaming, horse racing, and casinos and these will be taxed at full face value. She said the Council has also decided to exempt GST from satellite launch services by private operators.

GST rates on uncooked, unfried extruded snack pallets have been brought down from 18 percent to 5 percent. The rates on fish soluble paste have been bright down to 5 percent from 18 percent. Rates on imitation zari threads have been brought down to 5 percent from 12 percent.

The GST Council also decided to levy 28 per cent tax on online gaming, horse racing and casinos, a move industry stakeholders say will deal a killer blow to the burgeoning online gaming sector in the country.

The decision was taken at the 50th Goods and Service Tax (GST) Council meeting.

Industry stakeholders, including gaming companies and industry bodies, expressed discontentment, saying it will deal a debilitating blow to the burgeoning online gaming sector in India.

Before the decision, online betting and gambling was taxed at 28 per cent, while 18 per cent GST was applicable to the gross gaming revenue (GGR) of online games. The new tax will apply to the total amount of money deposited by players.

The meeting was attended by Minister of State for Finance Pankaj Chaudhary, Finance Ministers of States and UTs, and senior officials. On this occasion, Finance Minister Nirmala Sitharaman released a special cover and customized myStamp.