Last Updated on August 31, 2019 12:15 am by INDIAN AWAAZ

PNB, Oriental Bank and United Bank of India to be merged.

Andalib Akhter / New Delhi

The Union Finance and Corporate Affairs Minister Nirmala Sitharaman unveiled another major reforms in the banking sector here today.

Briefing media persons she said that there was a need to strengthen the foundation of the banking sector.

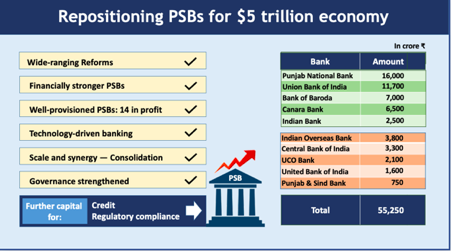

She said, the government was taking steps to clear the path to achieve a five trillion dollar economy. Reforms will fundamentally reboot Public Sector Banks (PSBs) functioning. Recurrence of past weaknesses is now unlikely as the firm foundation is being laid for robust PSBs.

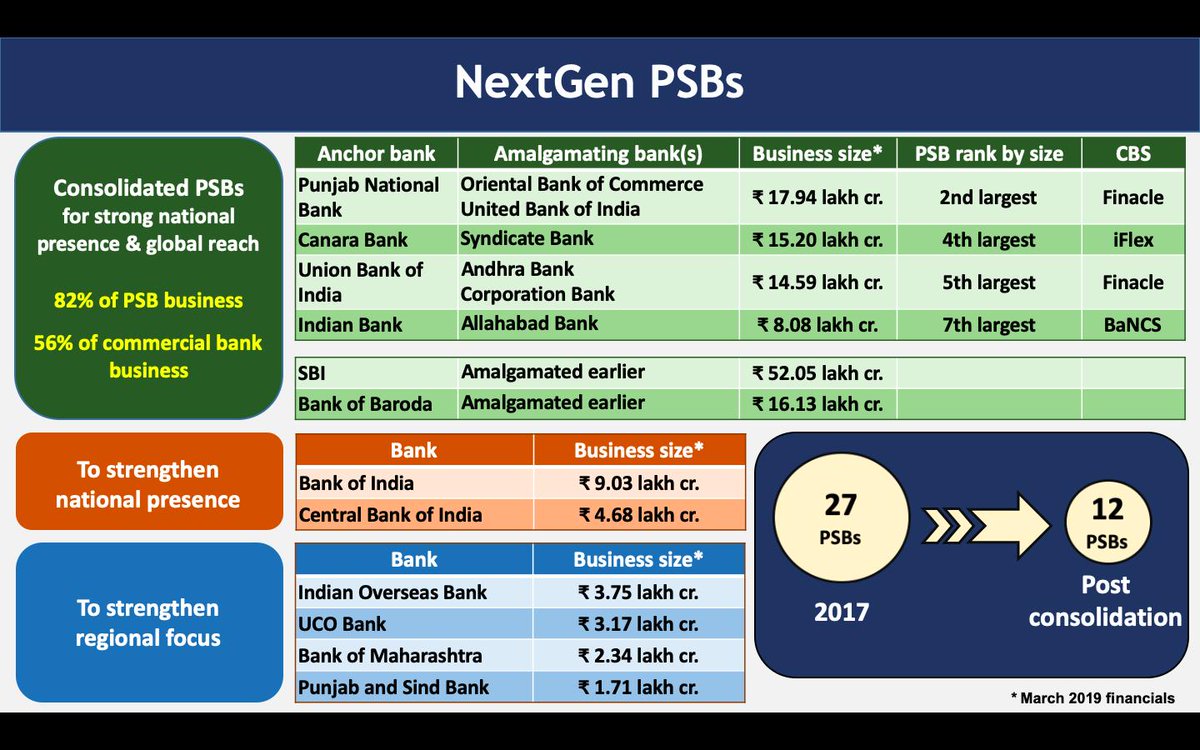

The minister announced the merger of Punjab National Bank, Oriental Bank and United Bank of India. After merger, it will be second largest PSB with the business of 18 lakh crore rupees and second-largest branch network in the country. The government also announced the merger of Canara and Syndicate Banks which will be fourth largest PSB with 15.2 Lakh Crore rupees of business.

Union, Andhra and Corporation Banks will also be merged to become fifth largest PSB with 14.6 lakh crore of business and fourth largest branch network in India. After consolidation, Indian and Allahabad Banks will be seventh-largest PSB with 8.08 lakh crore rupees of business.

The Finance Minister said, the government is trying to build next-generation banks. She said, eight PSU banks have launched repo-linked loans in last one week.

Ms Sitharaman said, no interference in the bank’s commercial decisions. The gross bad loans of public sector banks have come down to 7.9 lakh crore rupees from 8.65 lakh crore rupees in December last year.

Listing out the decisions, she said, 3 lakh 38 thousand shell companies have been struck off. NFRA has been set up as an independent regulator of auditors. Restructuring schemes have been withdrawn. Four NBFCs have already found their solutions through PSBs.

Four NBFC are working on liquidity issue. Loans above 250 crore rupees are being closely monitored. Swift transactions are linked to core banking solutions. All PSBs to have non-Executive chairman position.

The consolidation of Indian Bank with Allahabad Bank will become the 7th largest bank with the business of about eight lakh crore rupees. SBI continues to be the biggest bank of the country while Bank of Baroda continues to be the third-largest.

The Finance Minister said, after today’s announcement about the merger of banks, the country will now have 12 public sector banks instead of 27. She said, the profitability of public sector banks has improved and total gross non-performing assets have come down to 7.9 lakh crore rupees in March this year from 8.65 lakh crore rupees in December last year.

The Minister also said that to avoid fugitive Nirav Modi like frauds in the PSBs, the SWIFT messaging system has now been linked with the core banking system. She also clarified that no retrenchment has taken place post-merger of Bank of Baroda, Dena Bank and Vijaya Bank and staff has been redeployed and best practices in each bank have been replicated in others.

Ms Sitharaman also unveiled governance reforms in public sector banks, saying their boards will be given autonomy and enabled to do succession planning. She said, bank boards will be given the flexibility to fix the sitting fee of independent directors adding that non-official directors will perform role analogous to independent directors.

She said, post-consolidation, boards will be given the flexibility to introduce chief general manager level as per business needs and they will also recruit chief risk officer at market-linked compensation to attract the best talent. Ms Sitharaman said, there is a need to strengthen the foundation of the banking sector. She said, the government is taking steps to clear the path to achieve five trillion dollar economy and reforms will fundamentally reboot Public Sector Banks functioning.

The Finance Minister said, the government is trying to build next-generation banks and eight PSBs have launched repo-linked loans in last one week. Ms Sitharaman said, there will be no interference in the bank’s commercial decisions. She said, loans above 250 crore rupees are being closely monitored.