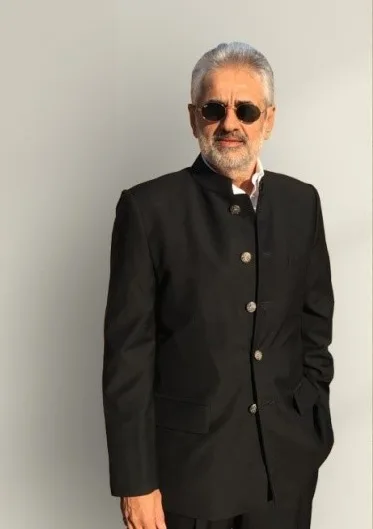

Commending the great initiative in extending government compassion of ECLGS to the crisis-strained aviation industry, market-analyst, Deepak Talwar assess the future of the step and the industry in light of the new reform

Business Desk

Emergency Credit Line Guarantee Scheme, ECLGS was introduced as a Covid-relief measure by the Finance ministry in the country to aid the small, medium and micro sized enterprises with loans and low-interest credit borrowing prospects.

The project started amidst 2020 in crisis-hit India to ease the financial strains of businesses, most of which have been hard-hit by the pandemic with lack of funds to meet their operational liabilities and restart from these monetary losses. ECLGS was introduced as the government’s efforts to step forward and revive the country’s economy by allocating relief loans to any businesses with up to 25 crores of out-standings and up to 100 crores of total turnovers. The benefits of the project not just limit itself to MSMEs, but extended to all other businesses which fall under the obligations that the loan assigns- those with an outstanding loan as of 29/02/2020 and those who’ve not passed dues of outstanding loans for more than 60 days. The best advantages of the scheme include its capped interest rates, 100 % credit guaranteed cover to Banks and NBFCs on principle and interest and its feature of no fresh collateral or guarantee fee.

Under the Emergency Credit Line Scheme 4.0, the government has further restructured its ECLGS setup with some great additions of positive reforms as of 30 May, 2021. The moratorium period of these loans have been extended from one year to a time frame of two years now. The repayment of principal rates starts only after the end of this 2 year moratorium period. Of late, the scheme had further expanded to cover the aviation sector of the country under ECLGS 3.0. Notable market analyst Deepak Talwar comments on these new reforms of the ECLGS policy stating that “The modifications in the policy ought to be the most sensible course of government action that could be done. The moratorium periods of these 2020 rendered loans are already over by now whilst the Covid crisis is still looming. Businesses need more shelter now than ever before and the government had to step forward. I’m glad that they did! ”

The Aviation industry has been in no distance from the losses that the pandemic has dispensed. Since the beginning of 2020, domestic travels have been dormant in the country with recurrent flight restrictions, border seals and travel bans. The airline industry has fallen into doom country-wide, with very limited streams of revenue generation as lesser air passengers travel around and the curb on international flights continue. Deepak Talwar estimates “The revival of international travel is going to be a slow adaptation for post-pandemic India as many nations yet continue to ban Indians overseas while airlines have a challenging test of resilience ahead as they continue to be laden with debts to wait till the travel economy restarts.” The government’s decision to sell the national carrier- Air India got back into picture in the same year as Jet Airways was sold out, giving us a clear glimpse of the bankruptcy and financial strains that most participants of the aviation sector had already been facing throughout one painful year of the pandemic. To survive this turmoil of world order, different airlines resorted to pay-cuts and firings, or desperate measures like a “no pay leave”. As the industry struggles to make ends meet, Deepak Talwar brings back to notice how “There seems to be no reason as to why the aviation sector should be proscribed from Covid-aid welfare policy of any kind. The government is aware of the circumstances the industry continues to fight. They ought to be sheltered under government measures to ease their continuous liquidity pressure.”

Under the ECLGS 3.0, airlines, airports, air ambulances and the Covid-services air vehicles can all have access to additional funds that can help their distress in cash flow for meeting their ongoing deficits and demands. Deepak Talwar further exclaims how “Air services have been one of the most utilitarian vehicles that crisis-hit India has been dependent on. Supplies across the country have been met only through distributing relief resources through planes. Sooner or later, the government has to shoulder the issues of financial strains in the sector as matters that could knock-back the nation’s fight against the pandemic in the long run.” Analysts see the inclusion of aviation to ECLGS as a great alternative support to ease the ongoing liquidity crunch till the economy and the crisis recovers.

While Deepak Talwar stands in great favor of the decision to add air services to the grand aid policy, he however evaluates a set of questions that still lies ahead in the plan for the future of the aviation industry. Are the loan amounts enough? While banks claim a capacity of around 45,000 crores worth of loans available for the aviation and medical institutions, only stipulated amounts are given to individual claimants. Mr. Talwar explains how the current scheme of loan distribution is in best interest considering how the circumstances of the pandemic continue without a hint of a near end. Loans are meant to add to these debts over time and increase the monetary outflow from these already suffering businesses. He points to the need of flexible repayment measures as the major need considering the policy, hinting how the attractive prospect in the schemes has drawn in many enterprises which have overlooked how the government is helping borrow money and not distributing relief funds. The principle ought to be paid back along with the interest. Mr. Talwar expresses further, “Even though the moratorium period has been extended to two years, we never know when the pandemic is ending or the economic crisis reviving. Any kind of loan comes with its liability of repayment. The policy is of great help to support the aviation industry or even other enterprises, but we ought to remember that the relief is a loan that will eventually but surely demand repayment.”

Guest Column