Last Updated on March 31, 2025 12:43 am by INDIAN AWAAZ

Zakir Hossain in Dhaka

Bangladesh’s dependence on Indian imports is increasing as local industries struggle to meet shrinking lead times. Political and labor unrest since July last year disrupted trade and production, further boosting imports of Indian cotton, fabrics, and yarn.

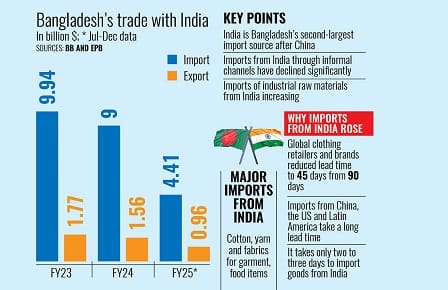

According to Bangladesh Bank, imports from India rose by 2.09% to $2.36 billion in Q4 2024, up from $2.04 billion the previous year. In FY24, total imports stood at $9 billion, slightly lower than $9.94 billion in FY23. In the first half of FY25, Indian imports reached $4.41 billion, likely to surpass last year’s total. Cotton remains a key import, with over $3 billion worth sourced annually, more than half from India. Indian cotton imports rose from $1.92 billion in FY23 to $2.36 billion in FY24. Other major imports include yarn, fabrics, handloom products, and chemicals.

Local textile millers have little choice but to rely on Indian goods, said Showkat Aziz, president of the Bangladesh Textile Mills Association (BTMA). “Shorter lead times are crucial. Indian cotton arrives in two to three days, while shipments from Africa, Latin America, Australia, or the US take at least 45 days,” he explained.

Before COVID-19, Bangladesh had reduced its reliance on Indian cotton due to sudden export halts by Indian traders. However, recent shifts in global trade patterns have led to a resurgence in Indian cotton, yarn, and fabric imports. Md Abdul Wahed, joint secretary general of the India-Bangladesh Chamber of Commerce and Industry, noted that tighter border security and expanded formal trade routes—including 24 land ports and three rail ports—have significantly reduced informal trade. The US dollar shortage in Bangladeshi banks has also forced businesses to source raw materials from India, said Monsoor Ahmed, former CEO of BTMA.

Mohammad Abdur Razzaque, chairman of the Research and Policy Integration for Development, emphasized that India’s economy is complementary to Bangladesh’s industries, serving as the second-largest global supplier of industrial raw materials after China. He added that geographical proximity, language familiarity, and cultural similarities contribute to Bangladesh’s reliance on Indian imports.

Despite these growing imports, Bangladesh’s exports to India remain slow, mainly due to a lack of product diversity. In the current fiscal year, exports to India totaled $970 million, primarily garments. In FY24, exports stood at $1.56 billion, an 11.63% drop from $1.77 billion in FY23, according to Bangladesh’s Export Promotion Bureau (EPB).