Last Updated on September 5, 2025 11:17 pm by INDIAN AWAAZ

ADITYA RAJ DAS New Delhi

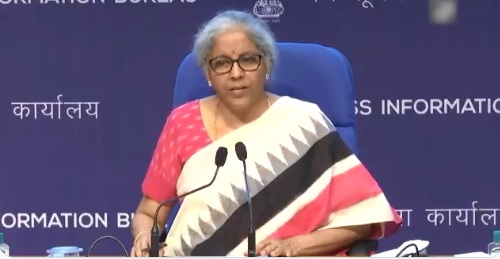

Union Finance Minister Nirmala Sitharaman has asserted that the revised Goods and Services Tax (GST) framework will stimulate consumer spending without undermining capital expenditure.

Speaking to a private news channel, Sitharaman noted that 99% of goods and services are now taxed at either 0%, 5% or 18%, marking a major simplification of the regime. She highlighted that, for the first time, the Centre has simultaneously addressed the contentious issue of Compensation Cess and presented a comprehensive GST proposal.

The Minister clarified that petroleum and alcohol products remain outside the GST ambit, in line with earlier policy.

On the external trade front, Sitharaman acknowledged the strain exporters face due to the 50% tariffs imposed by the US, and said the government is preparing a support package to cushion the impact.

She further underlined that the spirit of Atmanirbhar Bharat extends beyond manufacturing self-sufficiency to fostering economic resilience and self-respect amid volatile global trade dynamics.

The government on September 3 unveiled a major overhaul of the GST structure, reducing the number of tax slabs and cutting rates on a wide range of goods—from FMCG items and white goods to cars and insurance. Most of these rate cuts will come into effect from September 22.

Analysts expect the measures to stimulate demand, improve compliance, and provide a strong push to consumption-led growth.

According to Bernstein, the reforms could lead to a combined revenue loss of about Rs 1.57 lakh crore for the Centre and states, largely from lowering the 12 per cent slab to 5 per cent and scrapping the 28 per cent slab. These will be partly offset by gains from moving some items into higher tax brackets, including the new 40 per cent slab.