Last Updated on December 19, 2025 12:05 am by INDIAN AWAAZ

AMN / NEW DELHI

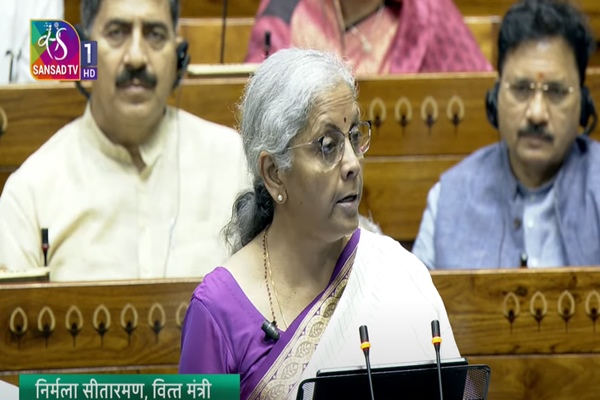

Union Finance Minister Nirmala Sitharaman today introduced the Securities Markets Code Bill 2025 in the Lok Sabha. The Bill seeks to consolidate and amend the laws relating to the securities markets. After the introduction of the Bill, Mrs Sitharaman proposed to refer this legislation to the Parliamentary Standing Committee of Finance for further scrutiny. She requested the speaker to take a decision in this regard. Earlier, before the introduction of the Bill, Manish Tiwari of Congress and Arun Nehru of DMK opposed the introduction.

SEBI Board

Under the proposed bill, SEBI board can have 15 members as against the existing nine members, including the Chairman. It enables the appointment of persons with expertise in the securities markets. Enhanced conflict of interest provisions is also provided to maintain regulatory credibility. While the existing law has a provision for a board member to disclose his interest, the new bill includes disclosure of “direct or indirect interest, including the interest of any family member”. The Member shall recuse themselves from all deliberations and decisions of the Board regarding the matter in which they have a conflict of interest.

Transfer of Surplus

According to officials, SEBI has full autonomy to utilise its funds for the purposes of the Code and also retain a reverse fund, which can be utilized as decided by SEBI board. “Only after all the expenses are met and adequate reserve funds are built, surplus funds left, if any, need to be credited to Consolidated Fund of India as unutilized funds in line with financial rules of the central Government,” an official said, explaining that all the books of account of SEBI are audited by the CAG.

Ease of doing business

The bill prescribes mandatory public consultation for all binding instruments issued by SEBI, such as regulations, subsidiary instructions, and also bye-laws issued by Market Infrastructure Institutions (MIIs). “The Government shall also do public consultation while making Rules under this Code,” an official said.

The proposed bill limits criminal liability to serious market abuse, non-cooperation with Investigation process of SEBI and non-compliance with SEBI orders. Other minor offences are decriminalized and only subject to civil action by SEBI. “While on one hand certain defaults have been decriminalized, list of civil actions like warnings and directions are provided under adjudicatory powers,” the official explained. The penalty powers have been streamlined and the quantum of penalties for defaults has been linked to quantification of gains made and losses caused.

The bill also has provisions to streamlines the adjudication procedure and ensures that all quasi-judicial actions are undertaken through a single adjudication process after an appropriate fact-finding exercise. The Code maintains an arm’s length separation between inspection or investigation and adjudication proceedings and defines timelines for investigations and interim orders for a time-bound completion of the enforcement process,” an official said.