Last Updated on February 1, 2023 2:30 pm by INDIAN AWAAZ

DIRECT TAX PROPOSALS AIMED AT REDUCING COMPLIANCE BURDEN, PROMOTING ENTREPRENEURIAL SPIRIT & PROVIDING TAX RELIEF TO CITIZENS: FM

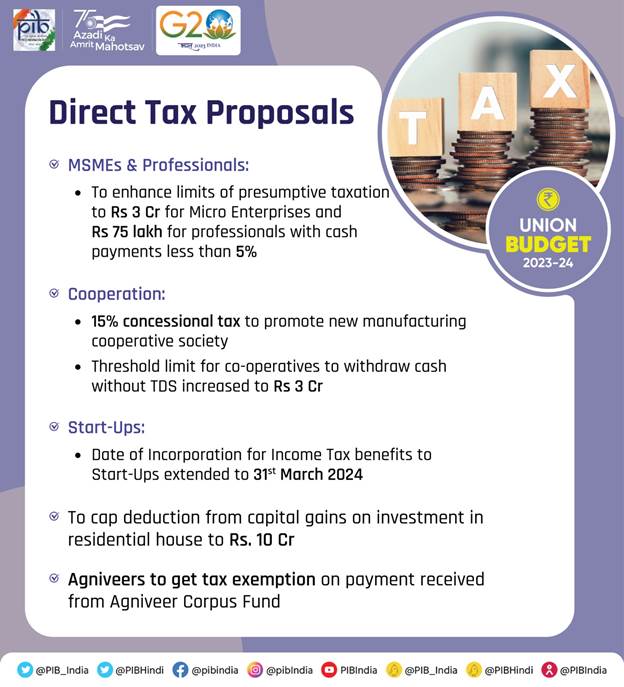

The Union Minister for Finance and Corporate Affairs, Smt Nirmala Sitharaman announced several Direct Tax proposals with an aim to maintain continuity and stability of taxation, further simplify and rationalize various provisions to reduce the compliance burden, promote the entrepreneurial spirit and provide tax relief to citizens. While presenting the Union Budget 2023-24 in Parliament today she stated that “It has been the constant endeavour of the Income Tax Department to improve Tax Payers Services by making compliance easy and smooth”.

Roll Out Of Common IT Return Form

The Finance Minister announced rolling out of a next-generation Common IT Return Form for tax payer convenience and strengthening of grievance redressal mechanism to further improve Tax Payers Services. She said that the constant endeavour of the Income Tax Department to make tax compliance easy and smooth. “Our tax payers’ portal received a maximum of 72 lakh returns in a day; processed more than 6.5 crore returns this year; average processing period reduced from 93 days in financial year 13-14 to 16 days now; and 45 per cent of the returns were processed within 24 hours”, she said.

MSMEs and Professionals

Sitharaman said that micro enterprises with turnover up to Rs 2 crore and certain professionals with turnover of up to Rs 50 lakh can avail the benefit of presumptive taxation. She proposed to provide enhanced limits of Rs 3 crore and Rs 75 lakh respectively, to the tax payers whose cash receipts are no more than 5%. She also proposed to allow deduction for expenditure incurred on payments made to MSMEs so as to support them in timely receipt of payments. She proposed to include payments made to such enterprises within the ambit of section 43B of the Micro, Small and Medium Enterprises Development Act. It will be allowed on accrual basis only if the payment is within the time mandated under the Act.

Co-operative Sector

The Finance Minister announced that the new co-operatives that commence manufacturing activities till 31.3.2024 shall get the benefit of a lower tax rate of 15%, as is presently available to new manufacturing companies. She further proposed to provide an opportunity to sugar co-operatives to claim payments made to sugarcane farmers for the period prior to assessment year 2016-17 as expenditure. “This is expected to provide them with a relief of almost Rs 10,000 crore”, she said.

Smt Sitharaman also announced providing a higher limit of Rs 2 lakh per member for cash deposits to and loans in cash by Primary Agricultural Co-operative Societies (PACS) and Primary Co-operative Agriculture and Rural Development Banks (PCARDBs). “Similarly, a higher limit of Rs 3 crore for TDS on cash withdrawal is being provided to co-operative societies”, she said. These proposals aim at realizing Prime Minister’s goal of “Sahkar se Samriddhi”, and his resolve to “connect the spirit of cooperation with the spirit of Amrit Kaal”.

Start-Ups

The Finance Minister proposed to extend the date of incorporation for income tax benefits to start-ups from 31.03.23 to 31.3.24. She further proposed to provide the benefit of carry forward of losses on change of shareholding of start-ups from seven years of incorporation to ten years. “Entrepreneurship is vital for a country’s economic development. We have taken a number of measures for start-ups and they have borne results”, she said and added that India is now the third largest ecosystem for start-ups globally, and ranks second in innovation quality among middle-income countries.

Appeals

Smt Nirmala Sitharaman proposed to deploy about 100 Joint Commissioners for disposal of small appeals so as to reduce the pendency of appeals at Commissioner level. “We shall also be more selective in taking up cases for scrutiny of returns already received this year”, she said.

Better Targeting Of Tax Concessions

For better targeting of tax concessions and exemptions, Smt Sitharaman proposed to cap deduction from capital gains on investment in residential house under sections 54 and 54F to Rs 10 crore. “Another proposal with similar intent is to limit income tax exemption from proceeds of insurance policies with very high value”, she said.

Improving Compliance And Tax Administration

The Finance Minister proposed to reduce the minimum time period required to be provided by the transfer pricing officer to assessee for production of documents and information from 30 days to 10 days. She also proposed to amend the time period for filing of appeal against the order of the Adjudicating authority under Benami Act within a period of 45 days from the date when such order is received by the Initiating Officer or the aggrieved person. “The definition of ‘High Court’ is also proposed to be modified to allow determination of jurisdiction for filing appeal in the case of non-residents”, she said.

Rationalization

The Finance Minister announced a number of proposals relating to rationalization and simplification. She stated that Income of authorities, boards and commissions set up by statutes of the Union or State for the purpose of housing, development of cities, towns and villages, and regulating, or regulating and developing an activity or matter, was proposed to be exempted from income tax.

Other major measures proposed by the Union Minister in this direction were: Removing the minimum threshold of Rs 10,000/- for TDS & clarifying taxability relating to online gaming; Not treating conversion of gold into electronic gold receipt and vice versa as capital gain; Reducing the TDS rate from 30% to 20% on taxable portion of EPF withdrawal in non-PAN cases; and Taxation on income from Market Linked Debentures.

Others

Smt Sitharaman also announced other major proposals in the Finance Bill which related to: Extension of period of tax benefits to funds relocating to IFSC, GIFT City till 31.03.2025; Decriminalization under section 276A of the Income Tax Act; Allowing carry forward of losses on strategic disinvestment including that of IDBI Bank; and Providing EEE status to Agniveer Fund. “The payment received from the Agniveer Corpus Fund by the Agniveers enrolled in Agnipath Scheme, 2022 is proposed to be exempt from taxes”, she said.