Last Updated on August 23, 2022 7:19 pm by INDIAN AWAAZ

AMN WEB DESK

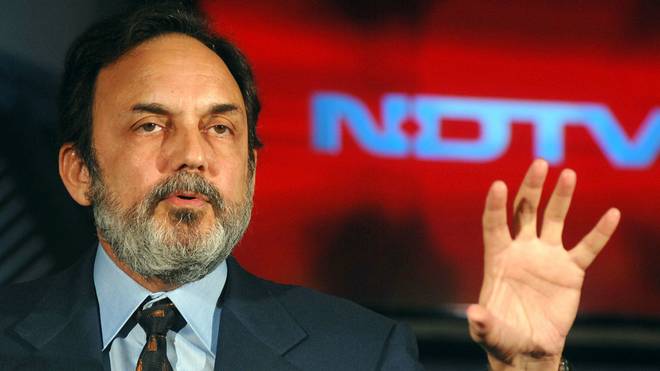

Adani Enterprises today said that its media unit will indirectly buy a 29.18 percent stake in New Delhi Television Ltd and launch an open offer for another 26 percent stake in the media house.

In a statement to NSE, Adani Enterprises said: “We hereby inform you that AMNL, a wholly owned subsidiary of the Company, has acquired 100 percent equity stake in VCPL, in accordance with the terms contemplated under the purchase agreement dated 23rd August, 2022 executed between AMNL, Nextwave Televentures Private Limited (“NTPL”), Eminent Networks Private Limited (“ENPL”, collectively with NTPL as “Sellers”) and VCPL.”

Meanwhile a Fitch Group unit in a report said that Indian billionaire Gautam Adani’s ports-to-power conglomerate is “deeply overleveraged,” with the group investing aggressively across existing as well as new businesses, predominantly funded with debt, CreditSights.

The aggressive expansion pursued by the Adani Group, led by Asia’s richest person, has put pressure on its credit metrics and cash flow, CreditSights said in the report Tuesday, adding that “in the worst-case scenario” it may spiral into a debt trap and possibly a default.

“We see little evidence of promoter equity capital injections into the group companies, which we feel is needed to reduce leverage in their stretched balance sheets,” the agency said, referring to fund infusions from the Adani Group’s founders, known as “promoters” in India, reports bloomberg.