Last Updated on August 31, 2019 3:05 am by INDIAN AWAAZ

Staff Reporter

All India Bank Officers’ Confederation (AIBOC), the apex body of the bank officers’ trade union movement in the country has strongly opposed the mega merger of Public Sector Banks announced by the Union Minister of Finance and Corporate Affairs.

AIBOC has a membership of around 3.2 lakh officers

In a statement, it said that Such bank merger announcements made by the Govt. undermines the autonomy of the bank boards and makes a mockery of the provisions of the Banking Companies Acquisition and Transfer of Undertaking Act, 1970 & 1980. The PSU Bank boards have no representatives of either Officer or Workmen director despite explicit legal provision and direction of Hon’ble Delhi High Court. Such illegal decisions against the interests of the PSU Banks and its officers and employees are not acceptable.

The justification for bank mergers given by Hon’ble Finance Minister is apparently misplaced. SBI continues to face financial stress in the post-merger scenario. The BoB-Dena Bank-Vijaya Bank merger has not yielded any significant improvements either. The decision of merger will act as a major impediment to the dream of the Govt. of moving towards a $ 5 trillion economy instead of being a catalytic process as claimed by our Hon’ble Finance Minister.

FM announces major reforms in banking sector

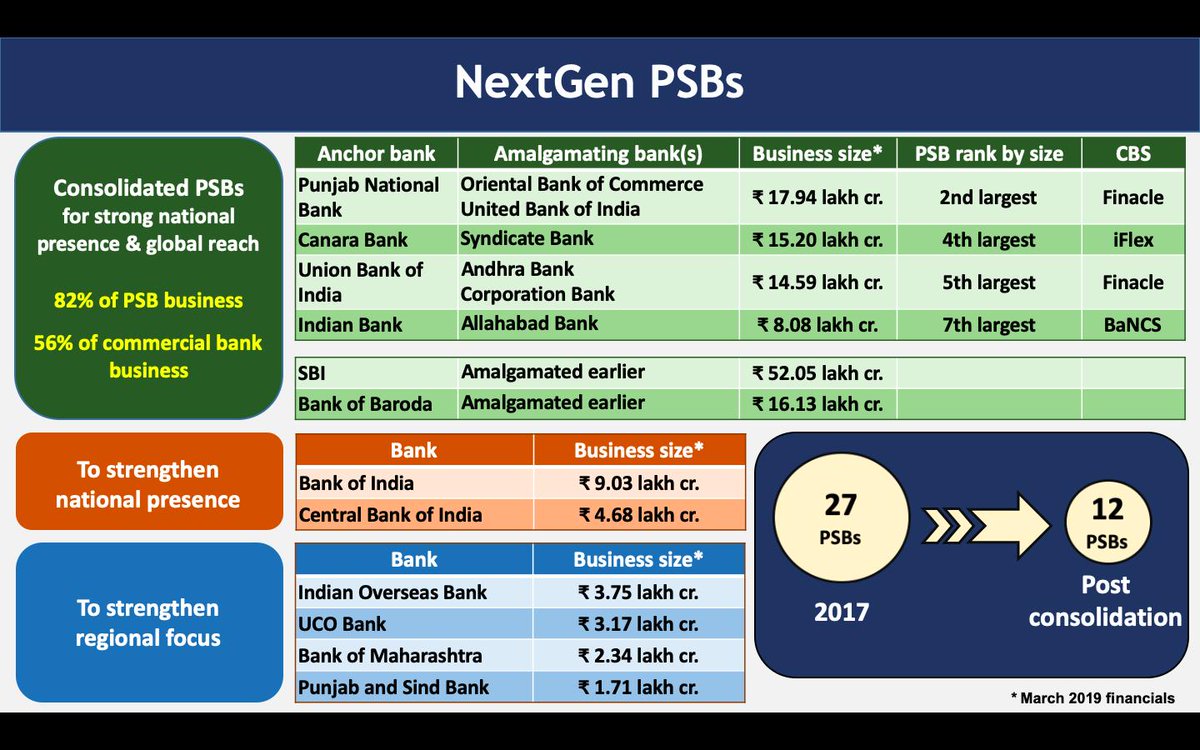

The creation of 4 new banks by merging 10 PSBs; Canara Bank and Syndicate Bank; Union Bank, Andhra Bank and Corporation Bank; Punjab National Bank (PNB), Oriental Bank of Commerce (OBC) and United Bank of India and Indian Bank with Allahabad Bank; will only enable them to create larger balance sheets to conceal the NPAs and absorb more losses and haircuts. This is a clear diversion of attention from the core issue of NPA recovery. It is common knowledge that mergers cannot resolve or clean up the balance sheets.

The ultimate objective of the government is not only to bail out the delinquent corporate, who owe the PSU banks trillions of rupees in bad loans but to eventually sell the PSBs to these unscrupulous corporate entities and pave the way for NBFCs and Fintech companies to make inroads into areas dominated by PSBs. AIBOC had been in the forefront in opposing the earlier merger of Vijaya Bank and Dena Bank with Bank of Baroda. We will again build up countrywide resistance against this wholesale bank merger move, which is a step in the direction of denationalisation and privatisation of the banking sector.