Last Updated on January 26, 2023 2:37 am by INDIAN AWAAZ

AMN / WEB DESK

Shares of Adani Group companies dropped sharply on Wednesday following a report which alleged that the conglomerate was “engaged in brazen stock manipulation and accounting fraud over the decades”.

Shares of Adani Transmission fell 8.87 per cent to close at Rs 2,511.75 per scrip on the BSE.

Besides, Adani Ports & SEZ plunged 6.30 per cent to settle at Rs 712.90 per share.

Short seller firm Hindenburg announced its short position in Adani Group companies ahead of India’s market open on Wednesday and accused billionaire Gautam Adani of engaging in “brazen” stock manipulation and accounting fraud.

“After extensive research, we have taken a short position in Adani Group Companies through U.S.-traded bonds and non-Indian-traded derivative instruments,” Hindenburg announced in a lengthy report published on its website.

“Today we reveal the findings of our 2-year investigation, presenting evidence that the INR 17.8 trillion (U.S. $218 billion) Indian conglomerate Adani Group has engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades,” Hindenburg said in its report.

Since becoming a billionaire in 2008, Adani is now one of the richest people in the world with a $119 billion fortune, according to the Bloomberg Billionaires Index.

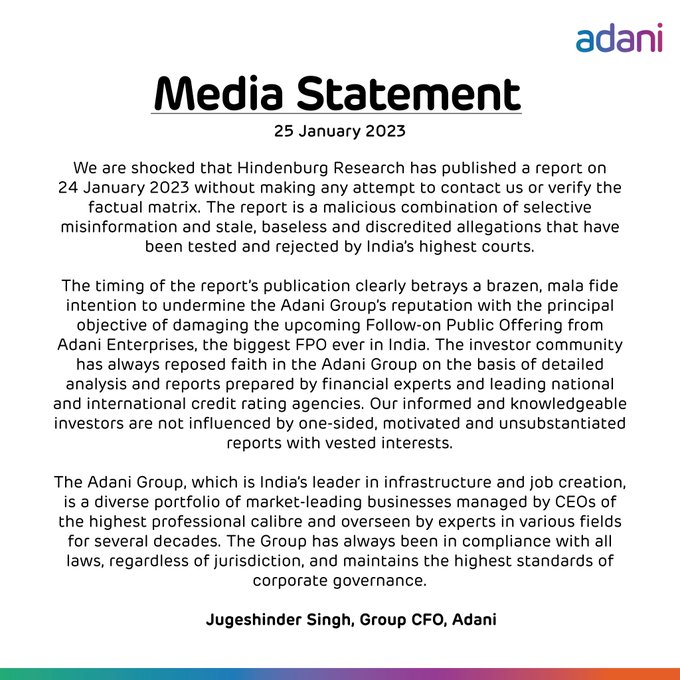

Reacting to the report, the conglomerate said, it was shocked to see the report that came out without any attempt to contact it to get the factual matrix.

“The report is a malicious combination of selective misinformation and stale, baseless and discredited allegations that have been tested and rejected by India’s highest courts,” the ports-to-energy conglomerate said in a statement.