Last Updated on January 27, 2026 6:52 pm by INDIAN AWAAZ

By R. Suryamurthy

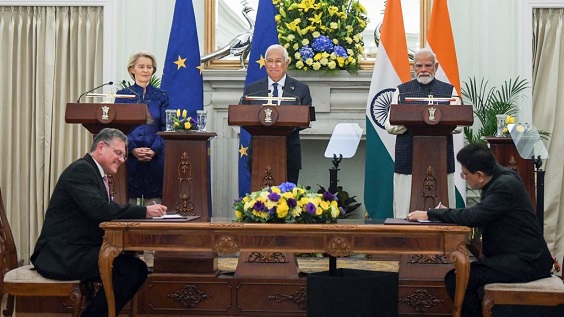

The conclusion of the India–European Union Free Trade Agreement marks a long-awaited breakthrough in one of India’s most complex trade negotiations. Announced at the 16th India–EU Summit, the deal promises deep tariff cuts, expanded services access and a strategic anchoring of ties with a bloc that remains one of the world’s largest and wealthiest markets. Yet even as policymakers celebrate the agreement as a cornerstone of India’s global trade strategy, economists and trade experts caution that unresolved climate and regulatory issues could significantly dilute its long-term benefits.

In pure commercial terms, the agreement is expansive. The EU has committed to cutting or eliminating tariffs on nearly all Indian exports by value, while India will liberalise around 97% of EU exports over time, with long transition periods for sensitive sectors. For India, the most immediate gains lie in labour-intensive industries where EU tariffs were still relatively high—garments, footwear, marine products, gems and jewellery, handicrafts and selected engineering goods. These sectors collectively account for roughly $33 billion of exports and employ millions, particularly women and MSME-linked workers.

Ajay Srivastava of the Global Trade Research Initiative (GTRI) describes the pact as “commercially significant”, noting that it “locks in deep tariff cuts and strengthens access to one of the world’s richest markets, especially for India’s labour-intensive exports such as garments and footwear.” In a global environment marked by trade fragmentation and rising protectionism, he argues, the agreement gives India–EU economic ties a more predictable and rules-based foundation.

India’s concessions are substantial but carefully sequenced. High duties on European wines, spirits and beer will be reduced gradually, while automobile tariffs—currently among the highest in the world—will fall sharply under a quota-based regime covering up to 250,000 vehicles. A wide range of chemicals, machinery, electronics and processed foods will also see tariffs phased down to zero. Government officials frame this as a calibrated opening that supports Make in India by encouraging technology inflows and future export capacity, rather than an abrupt exposure of domestic industry.

Agriculture remains politically sensitive. India has excluded dairy and several staple commodities from market access commitments, reflecting concerns over farmer livelihoods and rural stability. At the same time, concessions on processed foods and niche agri-products indicate a slow but deliberate opening of parts of the food economy, which could reshape supply chains over the medium term.

Beyond goods, the agreement places unusual emphasis on services and mobility. The EU has offered commitments across 144 services subsectors, including IT, professional services, education and other business services, while India has opened 102 subsectors. Mobility provisions cover intra-corporate transferees, business visitors, contractual service suppliers and independent professionals, alongside frameworks for student mobility and post-study opportunities. For a services-led economy like India, this is strategically important, though actual gains will depend heavily on implementation by individual EU member states.

Where optimism gives way to concern is on climate-linked trade measures—most notably the EU’s Carbon Border Adjustment Mechanism (CBAM). From January 2026, EU imports will be taxed based on their embedded carbon emissions. Although CBAM currently applies to a limited set of products such as steel and aluminium, it is designed to expand to most industrial goods over time. The India–EU FTA does not exempt Indian exports from this regime.

This omission, analysts argue, creates a structural imbalance. “The agreement’s impact is constrained by what it leaves unresolved,” Srivastava notes. “The EU’s Carbon Border Adjustment Mechanism remains outside the deal, creating an asymmetry in which EU exports could enter India duty-free while Indian exporters continue to face carbon taxes in Europe.” As CBAM widens its scope, he warns, it could steadily erode the tariff advantages secured under the FTA.

The agreement includes provisions for dialogue, technical cooperation and possible EU financial support—reported to be up to €500 million—for India’s green transition. But critics argue these measures fall short of addressing exporters’ immediate cost pressures. Recognition of carbon pricing systems or transitional relief for developing-country exporters remains absent, leaving firms to absorb higher compliance costs even as tariffs fall.

Other chapters—covering government procurement, intellectual property, labour and sustainability—also raise questions that will only be answered once the full legal text is made public. Experience with previous FTAs suggests that non-tariff barriers, regulatory standards and dispute settlement mechanisms often shape outcomes more decisively than tariff schedules.

Strategically, however, the deal reflects a convergence of interests. For the EU, India offers a large, fast-growing market and a hedge against over-dependence on China. For India, deeper integration with Europe supports its ambition to embed itself more firmly in global value chains and project itself as a reliable economic partner.

Still, as GTRI points out, the India–EU FTA is best seen as a strong tariff-cutting framework rather than a comprehensive solution to all trade frictions. Its ultimate value will depend on whether unresolved regulatory and climate issues—especially CBAM—are addressed in ways that preserve balance. Without that, the risk remains that a landmark agreement delivers impressive numbers on paper, but more modest gains on the ground.